Managing Accounts Receivables (AR) can be challenging in the best of times, especially when relying on manual processes. Whether your Foodservice distribution business is large or small, automating your AR offers significant benefits.

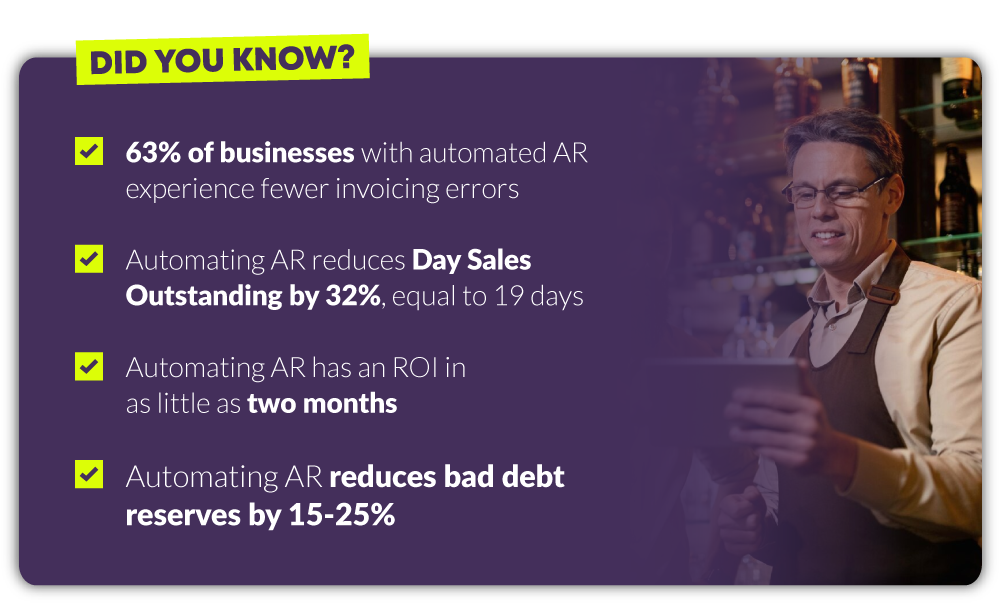

Automation eliminates the need for manual data entry and processing, enabling your AR team to generate invoices, distribute them to customers, and reconcile payments seamlessly. This not only improves accuracy but also enhances financial reporting and compliance. Did you know that 63% of businesses with automated AR experience fewer invoicing errors?

Automated AR systems accelerate the payment cycle by sending timely reminders, implementing automatic payment schedules, and offering convenient online payment options. This reduces DSO (Days Sales Outstanding), improving cash flow management and enabling businesses to reinvest capital more effectively. Some studies show that businesses automating more than half of their AR processes saw a 32% reduction in DSO—equivalent to 19 days.

By reducing the administrative burden of manual AR processes, automation leads to significant cost savings. Manual processing can cost between $15-40 per invoice, which adds up quickly with high volumes. Automation boosts productivity, profitability, and competitiveness in the marketplace. Industry analysts report that automated AR can deliver ROI in as little as two months.

Automation also provides real-time visibility into AR, allowing your team to monitor outstanding invoices, track payment status, and forecast cash flow more accurately. These insights enable proactive cash flow management, helping businesses identify potential liquidity issues early and take timely corrective measures to maintain financial stability.

Other benefits include improved customer relationships due to increased convenience, streamlined reporting and compliance, and the scalability of an automated AR solution. Download our whitepaper to learn more.

Despite these significant benefits, only only 17% of small businesses are taking advantage of AR automation. But why is that?

It could be due to the challenges associated with implementing AR automation.

Challenges of Automating AR

- Complexity of integration: Integrating automated AR systems with existing ERP or accounting software can be complex and time-consuming. Outdated systems, compatibility issues, data migration challenges, and system interoperability can require careful planning and technical expertise to resolve successfully.

- Security concerns: Businesses often worry about the security of cloud-based systems. However, with modern advancements in cloud computing and security, these concerns are largely unfounded. To mitigate risks, it’s crucial to choose a reputable software provider that prioritizes security.

- Customization and configuration: Every business has unique needs, which may necessitate extensive customization and configuration of the automated AR system. This can increase both the complexity and the cost of implementation.

- User adoption and training: The success of AR automation hinges on effective user adoption—by both your staff and your customers. Providing comprehensive training, user-friendly interfaces, and ongoing support is essential for ensuring that users fully embrace the new system.

While AR automation offers significant long-term benefits, the initial implementation and integration costs can be challenging for some businesses. You can overcome these challenges by taking a holistic approach, combining the technical expertise of your provider with the operational knowledge of your AR team. This will help minimize costs and maximize the ROI of automating AR.

What are the components of Automated AR?

Automated AR is designed to make your life easier by streamlining and simplifying your Accounts Receivables process. Here’s how it works:

Invoice generation and distribution

- Automatically generate invoices based on predefined templates, customer data, and transaction details, ensuring consistency and accuracy.

- Customize templates to reflect your branding, payment terms, and other relevant information.

- Distribute invoices to customers via email, electronic billing platforms, or integrated customer portals, ensuring timely delivery and receipt.

- Route invoices and payment requests to the appropriate stakeholders for review and approval based on predefined rules, roles, and authorization levels, reducing manual intervention and speeding up decision-making.

Payment processing

- Integrate with various payment gateways, banking institutions, and processors, enabling customers to pay conveniently using credit cards, electronic funds transfer (EFT), or other methods.

- Send timely payment reminders to customers with outstanding invoices, reducing the likelihood of late payments and improving cash flow.

- Provide customers with secure online payment portals where they can view and pay invoices, track payment history, and manage payment preferences.

- For industries where checks are still a predominant payment method, businesses can modernize the acceptance and processing of check payments with the help of mobile payment capabilities. By allowing field representatives and/or customers to select invoices and take a picture of the check in the field, payments not only get to the bank faster and more securely, but all necessary cash application data is also associated with the payment automatically for reconciliation.

Data integration and reporting

- Seamlessly integrate with accounting software like QuickBooks or Xero to synchronize invoice data, payment records, and financial transactions in real time.

- Gain real-time visibility into AR, enabling efficient monitoring of outstanding invoices, tracking payment status, and identifying overdue accounts.

- Generate comprehensive reports on receivables performance, aging accounts, customer payment trends, and other key metrics, empowering data-driven decisions and optimizing financial processes.

Document management and archival

- Manage and digitally organize invoice documents, payment receipts, and other relevant files, eliminating the need for paper-based documentation.

- Archive historical invoice data and payment records, allowing quick retrieval and access to past transactions for auditing, reporting, and compliance purposes.

The ROI on automating AR can be significant—reducing DSO by 32% and bad debt reserves by 15-25%. The reasons to automate AR have never been more compelling. By embracing automation, you can position your Foodservice business for success, stay competitive, and deliver value to both your customers and your bottom line.

Want to learn more? Talk to us. www.cutanddry.com